Areas of expertise and interventions

Here we present to you our areas of expertise. Even if you do not find the object of your research, simply contact us and we will help you to access your request.

FAMILY LAW :

Divorce :

• Divorce by mutual consent

• Divorce for permanent alteration of the marital bond (two years)

• Divorce request-accepted, i.e. by acceptance of the principle of marriage breakdown

• Divorce for fault

• Application for modification of alimony

•Modification of the right of visit and accommodation

• Domestic violence

• Filiation

• Adoption

• Marital status

CONTRACT LAW:

• Purchase/sale contracts,

Learn more

• Supply contracts,

Manufacturing,

• Distribution contracts,

• General conditions of purchase and sale,

• General conditions of use of the website,

• Service provision contracts,

• Business provider contracts,

• Partnership contracts, etc...

FOREIGN LAW:

• Expatriate worker,

Learn more

• Situation of illegal residence in France,

• Obligation to leave French territory,

• Asking for asylum,

• Applicant for French naturalization,

• Foreign student,

• Rrenewal or refusal of a residence permit,

• Deportation or escorted back to the border,

• Ban on returning to the territory, etc...

BANK RIGHT :

Relations between banks and borrowers:

• Disputes over mortgages,

• Excessive real estate loans,

• Unpaid situation,

• Property foreclosure procedure,

• Warning fault,

• Failure to provide excessive credit,

• Incorrect overall effective rate of a home loan,

• Forfeiture of the right to interest, conventional or substitution of the nominal rate by the legal interest rate,

• Bank error in the calculation of the TEG appearing in the loan contract,

• Professional loans,

• Sureties disproportionate to the income or assets of the uninformed surety,

• Liability of the insurer or insurance intermediary in the event of unsuitable financial investments,

• Violation of legal provisions by the insurer,

• Safeguard, reorganization or judicial liquidation,

• Difficulty or cessation of payments,

• Proceedings before the judge-commissioner.

SOCIAL RIGHT :

COMPANIES:

Learn more

• Assistance in the management of human resources,

• Business support,

• Contractual relations with employees,

• Drafting of employment contract,

• Termination of employment contract,

• Warning mail,

• Recall the order,

• Call for preliminary interview,

EMPLOYEES :

• Work accident,

• Professional diseases,

• Inexcusable mistake,

• Right in the performance of their employment contract,

• Procedure for contesting a dismissal.

REAL ESTATE LAW :

• Disputes in case of real estate sales,

Learn more

• Contracts and Obligations,

• Contractual civil liability,

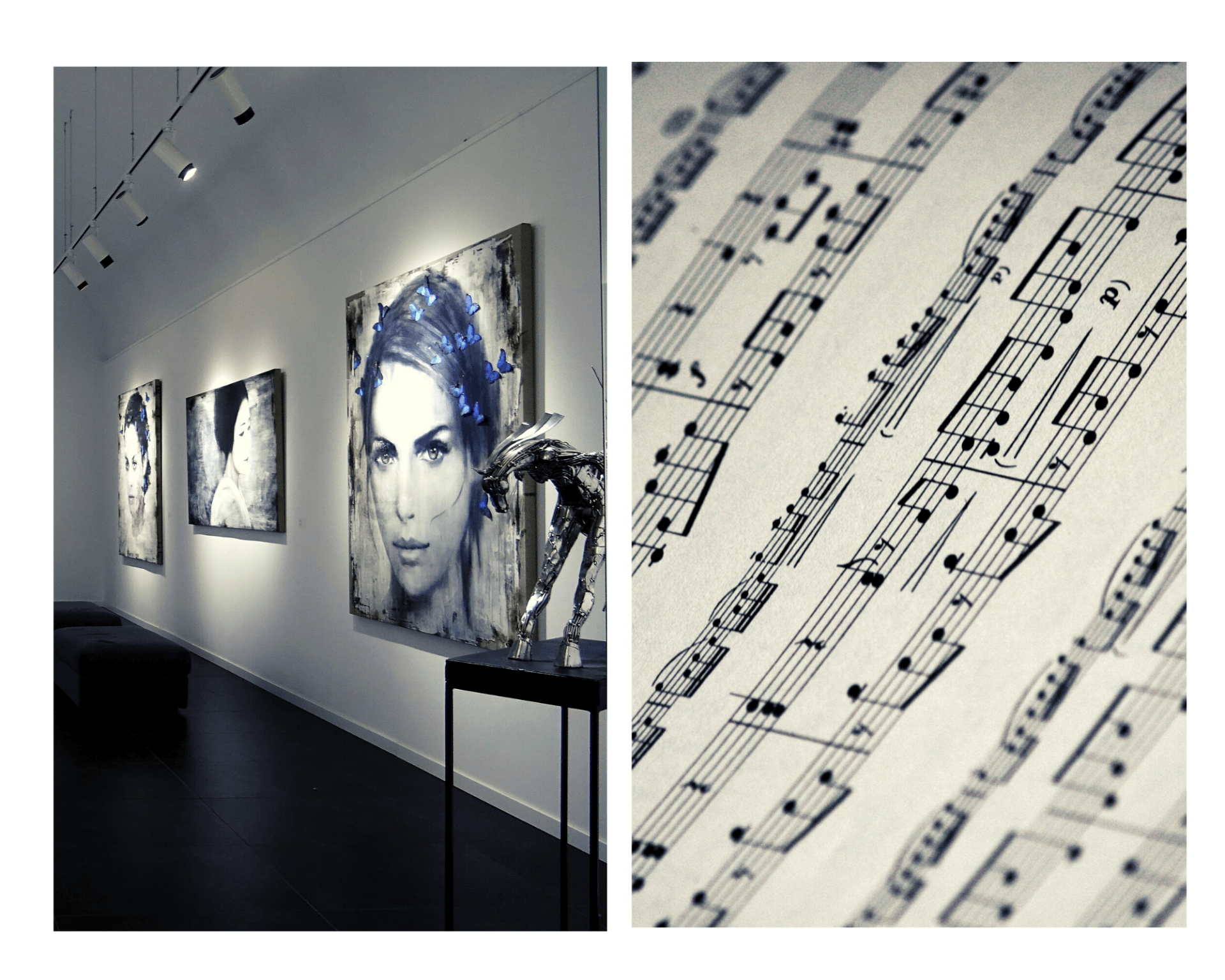

ARTISTS REPRESENTATIVE:

Since 2017, the activity of agent of authors and artists is considered compatible with the exercise of the profession of lawyer. Thus, on the strength of their ethics, lawyers are able to represent the interests of authors, performers and their works.

What is an Authors' and Artists' Agent?